PEMODELAN DATA SAHAM MENGGUNAKAN ANALISIS TIME SERIES DENGAN PENDEKATAN COPULA GAUSSIAN

Abstract

One method of predicting stock prices is to use the time series analysis method. In this method, a linear prediction model is made to see patterns from historical stock price data to assess future prices. The stock data used in this study is the daily stock data of PT. Telkom and PT. Indosat in 2020-2021. Autoregressive (AR) model is a time series model that is often used with the assumption that its volatility does not change with time (Homoscedastic). After analyzing the AR Model(1) data for the stock data of PT. Telkom and PT. Indosat has a non-independent error, therefore the AR(1)-N.GARCH(1,1) time series model construction was carried out to model the error (ϵ_(i,t)). Furthermore, the error of the AR(1)-N.GARCH(1,1) model is independent of t, so it can be modeled using Copula. After the Copula model was applied to the data and obtained the value of the fit of the Gaussian Copula distribution error model. From the values generated from the Gaussian Copula C({ϵ_(i,t) }_(t=1)^T ),T=1,2,…, and approximates a uniform distribution. So the stock data of PT. Telkom and PT. It can be said that Indosat is not suitable to be modeled with the Gaussian Copula.

Keywords

Full Text:

PDFReferences

Brockwell, P. ., & Davis, R. A. (1996). Introduction to Time Series and Forecasting. Springer Verlag.

Brummelhuis, R., & Kaufmann, R. (2004). Time Scaling for GARCH (1,1) and AR (1)-GARCH (1,1) Processes. 1.

Caraka, R. E., Yasin, H., & Prahutama, A. (2015). Pemodelan General Regression Neural Network (GRNN) Pada Data Return Indeks Harga Saham Euro 50. Gaussian, 4, 181–192.

Casella, G., Fienberg, S., & Olkin, I. (2006). Springer Texts in Statistics. Design, 102, 618. https://doi.org/10.1016/j.peva.2007.06.006

Goorbergh, R. van den. (2004). A Copula-Based Autoregressive Conditional Dependence Model of International Stocks Markets. DNB Working Paper :022 Amsterdam, Netherlands. https://ideas.repec.org/p/dnb/dnbwpp/022.html

Jannah, M., & H Fitri, I. N. (2019). Penaksiran Parameter Model

Autoregressive Orde (1) Dengan Menggunakan Metode Likehood Maksimum. MAP Journal, 3(1), 38–48.

Li, J. (2010). Application of Copulas as a New Geostatistical Tool [Disertasi, Universität Stuttgart]. In Stuttgarrt Inst.Fur Wasserbau. https://doi.org/http://dx.doi.org/10.18419/opus-332

Nelson, B. (2005). An Intoduction to Copulas. Springer.

PT Bursa Efek Indonesia. (n.d.). Retrieved August 28, 2021, from https://www.idx.co.id/produk/saham/

Schölzel, C., & Friederichs, P. (2008). Multivariate non-normally distributed random variables in climate research – introduction to the copula approach. 761–772. https://doi.org/https://doi.org/10.5194/npg-15-761-2008, 2008

Yahoo Finance - Stock Market Live, Quotes, Business & Finance News. (n.d.). Retrieved August 28, 2021, from https://finance.yahoo.com/

Zhu, Y., Ghosh, S. K., & Goodwin, B. K. (2008). Modeling Dependence in the Design of Whole Farm - A Copula-Based Model Approach. American Agricultural Economics Association Annual Meeting, 1–21.

Refbacks

- There are currently no refbacks.

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.

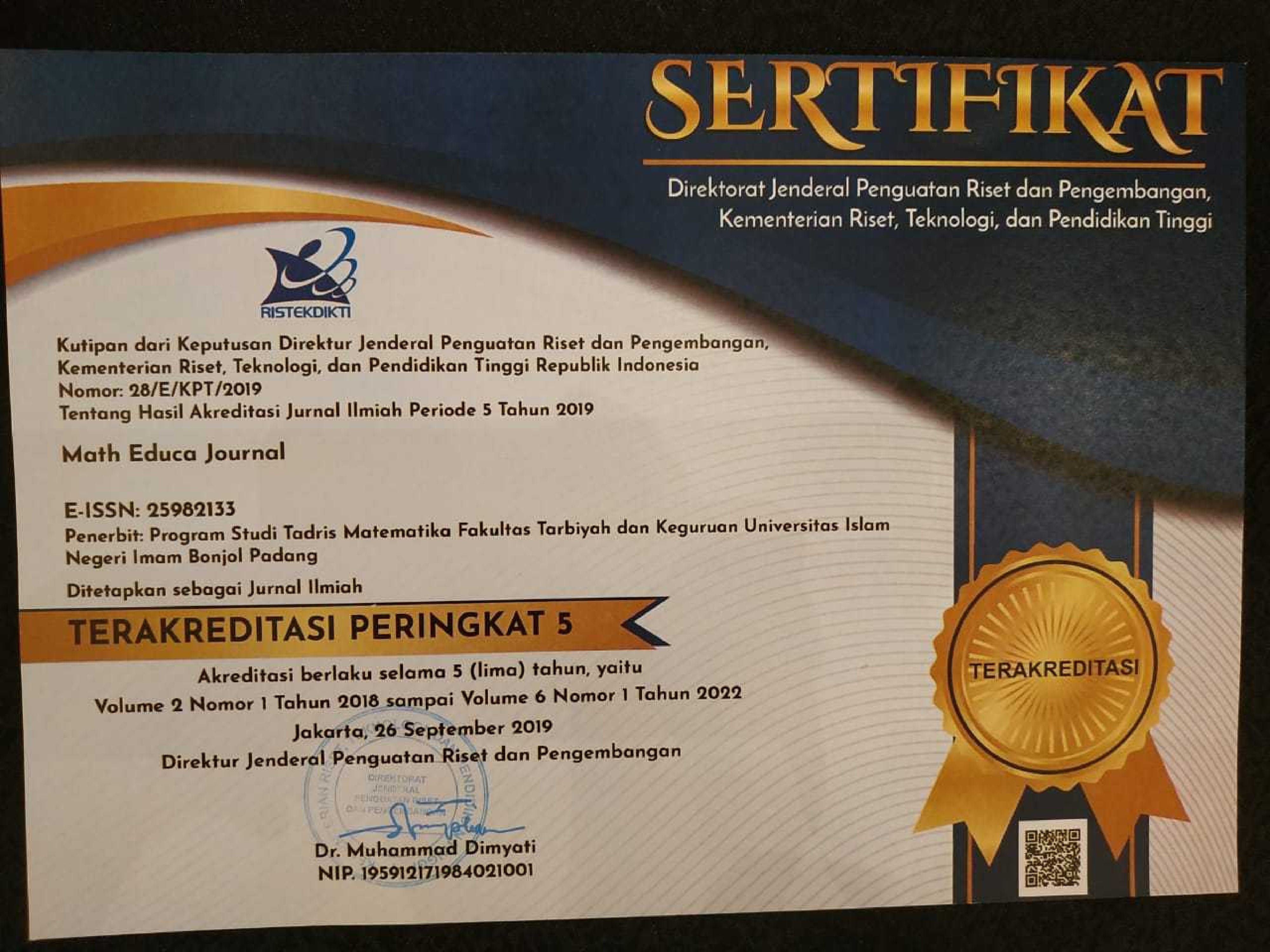

The Journal Space of the Mathematics Education Department

Faculty of Education and Teacher Training

State Islamic University of Imam Bonjol Padang

Email: mej.uinibpadang@gmail.com

Math Educa Journal is licensed under a Lisensi Creative Commons Atribusi-NonKomersial 4.0 Internasional.

Based on a work at https://ejournal.uinib.ac.id/jurnal/index.php/matheduca.

All rights reserved p-ISSN: 2580-6726 | e-ISSN: 2598-2133